Welcome to part three of our series on down rounds and recaps:

- Part 1: A Guide to Down Rounds and Recaps

- Part 2: Managing Your Key Stakeholders

- Part 3: A Deep Dive Into Down Rounds <- You are here

- Part 4: Navigating the Startup Recap

Let’s get into it.

If we’re going to talk about down rounds, we’re going to do it with a sense of hope and optimism.

You need to raise a down round for one of two reasons.

➡️ You’ve been unable to gain the traction needed to reach that next round at a higher valuation.

➡️ Investor sentiment has suddenly shifted, and the valuation from your last round no longer makes sense.

The good news is that you’ve convinced investors that putting more cash into your startup is worthwhile.

📈 They believe more runway will allow you to hit critical milestones and stay Default Investable.

💰Or they expect you to use the time to find an M&A opportunity that provides some return on their investment.

Either way, you can put more cash in the bank, extend your runway, and stay in the game. Not every founder in your situation will have that opportunity.

Valuation – more art than science

Valuation, particularly in the private markets, is driven by two basic human emotions: fear and greed.

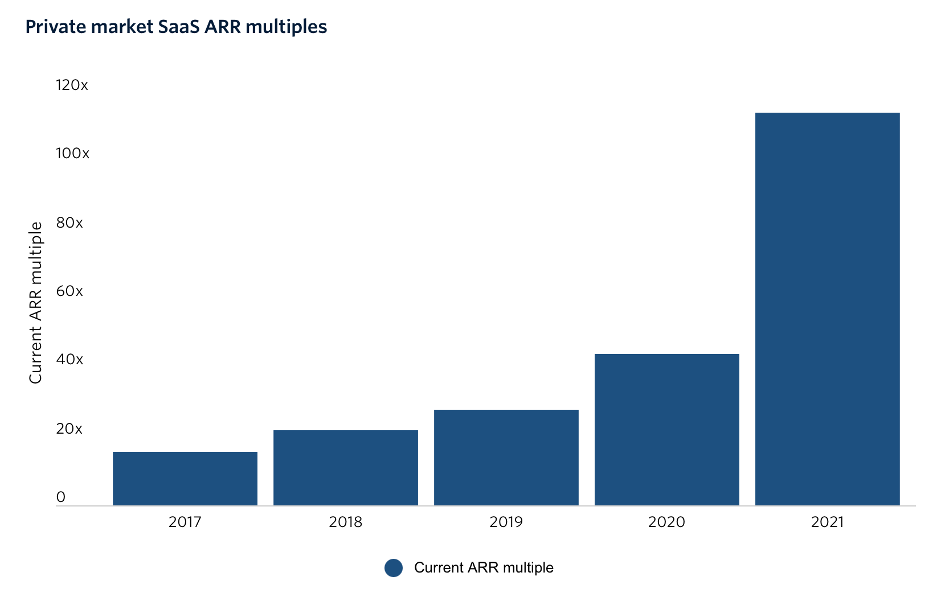

Consider SaaS revenue multiples. In 2017, SaaS revenue multiples were 15.5x ARR (annually recurring revenue). By 2021, revenue multiples had exploded to 114.3x ARR.

That means, all other things being equal, a SaaS startup in 2021 was worth more than 7x that same SaaS startup in 2017!

Why? Two reasons. The VC investment bubble of 2020 – 2022. And Covid led investors to believe that a permanent shift in human behavior would benefit SaaS startups.

A wave of investor cash chased a finite number of quality SaaS deals, and revenue multiples exploded. 💥

By the end of 2023, it’s projected that SaaS startup multiples will return to where they were in 2017, leaving plenty of SaaS founders facing a down round in the future.

Yes, down rounds happen because founders miss key milestones and can’t increase their valuation before their next round of funding.

But we can’t discount the impact that macro factors, fear, and greed can have on startup valuations.

Dilution x Valuation

Dilution is a natural consequence of raising outside capital. Every round of funding results in founders, employees, and earlier investors owning less of the company.

Dilution is fine when the valuation is going up. Owning less of something worth much more is the roadmap for venture-backed startups.

But a down round exacerbates the impact of dilution. For you. Your team. And for investors that don’t participate in the round.

This creates dynamics that we need to address.

Your investors and the down round

Your current investors typically lead down rounds.

If an outside investor leads a down round, this new investor will likely require a recapitalization, demanding painful concessions from existing investors. We’ll cover that scenario in a future post in this series.

Your investors have two considerations in view as they negotiate a down round.

Offsetting dilution and protecting future returns

From the investor’s perspective, down rounds require a high level of conviction that the investor isn’t just throwing good money after bad.

Their portfolio returns will take a hit as they write down the value of their investment in your startup.

Meanwhile, the other partners in their firm will challenge the wisdom of funding a down round rather than investing in other higher potential opportunities.

Your investors will try to protect the downside of this additional investment as much as possible while trying to position their firm for a better outcome in the future.

Examples include:

- Higher liquidation preferences: Your original investment likely had a 1x liquidation preference. Don’t be surprised if your investors require a higher preference for a down round investment.

- Anti-dilution provisions: If your investors didn’t have anti-dilution protection before, you can expect they will ask for it now. Anti-dilution provisions adjust the rate at which preferred shares convert into common shares, thus potentially increasing the number of common shares a preferred shareholder would receive during an exit. This serves to increase the dilution borne by founders and their teams.

Remember, everything is negotiable. Rally your most supportive investors to negotiate the least onerous terms to protect your cap table.

Pay to play

Pay-to-play provisions allow existing preferred investors to compel other preferred investors to participate in a down round or subject them to penalties. These penalties can include fully converting their preferred shares to common shares. This conversion results in the loss of all of a preferred shareholder's rights, including liquidation preferences, anti-dilution provisions, and preferred voting rights.

Pay-to-play keeps investors’ interests aligned and benefits investors who support your startup financially from round to round, in good times and bad.

For obvious reasons, pay-to-play is a tough pill for investors who either can’t or don’t want to invest additional cash into your down round.

Invoking pay-to-play can invoke strong feelings among your investors, and discussions between your investors can get quite contentious. Use your outside counsel and lead investors as a buffer when discussions get charged.

Protecting you and your team

It’s not enough to just put more cash in the bank.

You have a long journey ahead. A lot of hard work is still to be done. Let’s be sure that you keep your best people along for the ride and that if you’re successful, you’ll reap the financial rewards.

As you work through your down round, there are three things you must do to protect yourself and your team.

Address dilution and valuation head-on

As discussed above, a down round will significantly dilute you and your team. It will also likely push many of your employee stock options underwater, meaning that the strike price is lower than the current value of the common stock.

You have to address both issues to retain your best people.

Here’s your three-step plan.

- Update your 409a, lowering your strike price for new options. You can start this process even as you are finalizing your down round.

- Increase your option pool so that you can issue new options to employees to offset the impact of dilution.

- Replace underwater options with new grants. Work with your counsel to ensure you execute this process correctly.

Develop this plan with your investors as you negotiate the specific terms of your down round. Don’t wait until after the round is closed to raise these points. They are crucial to managing your employees through this difficult time, and your investors will negotiate their investment with the impact of your plan in mind.

Set your employees up for success

You must retain your best people to navigate the choppy waters ahead.

- Be as transparent as possible. Employees will learn about the down round whether you tell them or not. So explain it to them. Reinforce that your investors support you through this difficult time, and remind them that not every startup is so lucky.

- Make the hard choices required to give you the best chance of meeting them. Make no mistake. There isn’t a second down round in your future. Cut costs, do fewer things better, and align your team behind your decisions. Don’t let your team suffer death by 1,000 cuts.

- Set goals they believe they can achieve. You and your team have been on a relentless hamster wheel, only to end up on the brink of failure. You’ll lose your best people within months if they think you’re falling into the old trap of chasing unattainable growth.

Don’t do a bad deal

It’s not just about putting more money in the bank and extending your runway. You can end up agreeing to terms that ensure you won’t see any cash from your most probable exit scenarios.

You don’t have to sign up for that result. Your ability to walk away from a bad deal is leverage when your investors are trying to preserve as much value as possible.

Have capable outside counsel who can guide and advise you throughout this process.

Your cap table waterfall, which shows how cash is distributed in an exit, is the roadmap to finding an acceptable path to navigating a down round while still protecting your interests.

It’s not just about the cash. It’s about the future. Have a good advisor by your side, and do the math.

Final thoughts

Why go through the pain of a down round?

Because you still believe. You believe in your vision. You believe you can create value for yourself, your team, and your investors. And you want to keep fighting to prove yourself right.

Do it, put your head back down, and start building again. You now have all those mistakes behind you, laying a foundation of experience and wisdom to guide you.

Note: The concepts of investor rights, the mechanics of preferred stock, and the technical aspects of executing a down round are complex. Remember to always consult with your legal counsel or other professional advisors before making any decisions or taking actions based on the content of this article