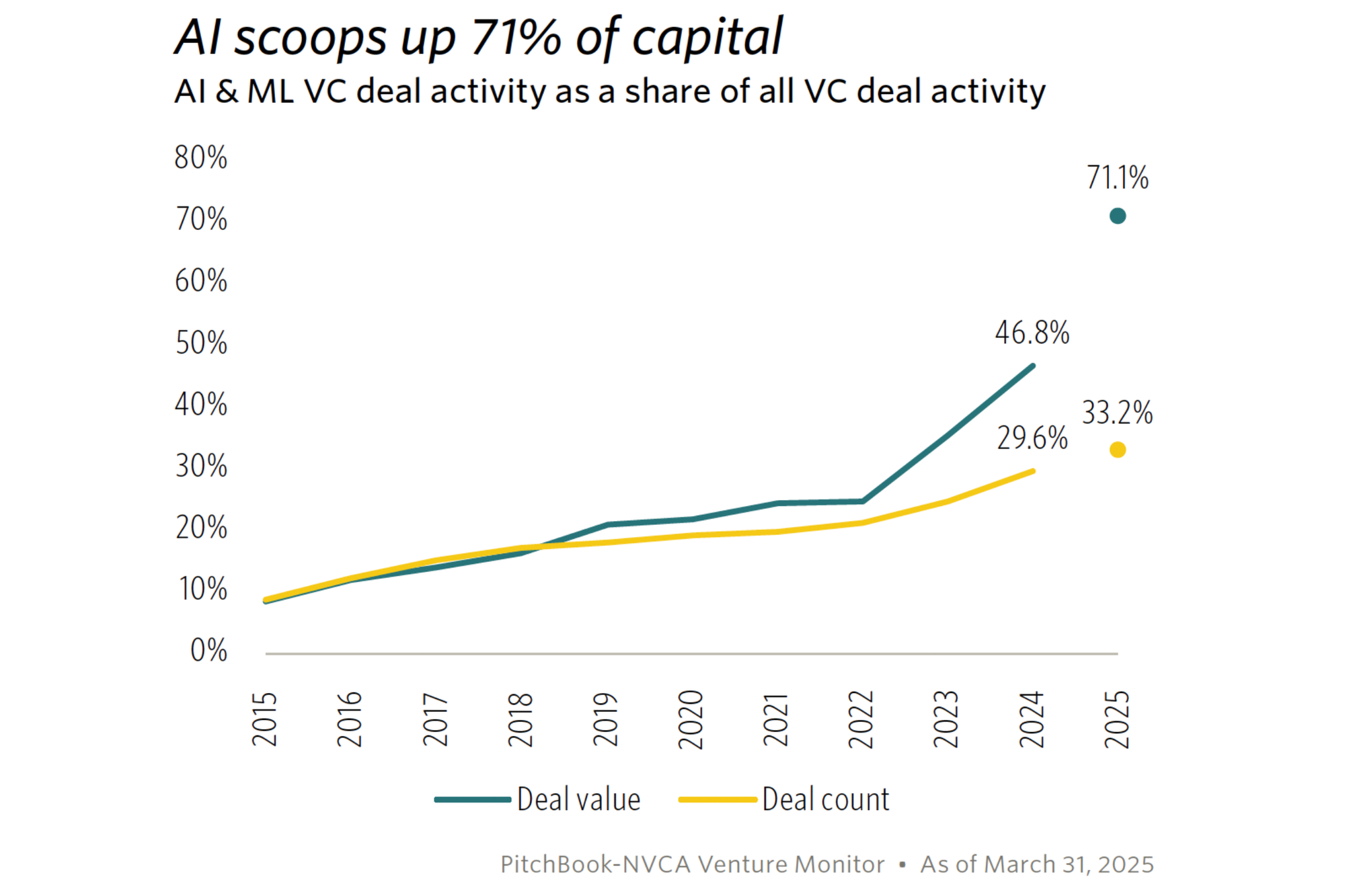

AI startups captured 71.1% of all venture deal value in Q1 2025.

Let that sink in. Nearly three-quarters of VC capital deployed last quarter went to one sector.

This isn't just a headline about a hot category. It's a warning about how narrow the path to venture capital is becoming—and how much harder that path may be for everyone else.

When deal value gets this concentrated, it often means two things:

- A few large deals (or a few dozen) are distorting the average. Nearly half of the $91 billion invested in Q1 went to OpenAI ($40 billion) and Anthropic ($4.5 billion).

- Other sectors—those perhaps less buzzy but still high-potential—are getting crowded out.

If you're building in AI

- Remember that capital doesn't equal product-market fit. Investor behavior is inflating valuations at a pace that dynamics on the ground haven't caught up to. Stay disciplined. Optimize for signal, not hype.

- You're also in a crowded arena now. 2023 was about building in AI. 2025 is about differentiation. What's your wedge? Why is this product inevitable in a world already filled with chatbots and agents?

If you're building outside AI

- Fundraising got harder. VC attention is finite — your ability to cut through matters more than ever. You'll need a sharper story, clearer traction, stronger metrics—and existing investor support that compounds belief.

- Consider non-dilutive capital or alternative funding sources. Now's the time to explore everything from revenue-based financing to strategic partnerships.

- That said, this level of concentration may create overlooked opportunities in other sectors. Fewer dollars often mean less competition and more room to maneuver. Refine your narrative. Why now? Why this space? Why you? Make your pitch impossible to ignore—even in a crowded room.

We've seen this movie before

From mobile to crypto to web3, mega-trends attract mega-capital. But not every cycle ends the same way.

AI may be the long-term platform shift we've all been waiting for. But the market is evolving quickly. The only thing we know for sure is that many of the bets being made right now will ultimately fail to deliver venture-scale returns...or any returns at all.

Stay prepared. Stay intentional. The shape of this market may change, but the discipline you bring to your process will always matter.