Founders often view a bridge round as a safety net. A way to buy time to fix metrics.

But the data shows that if you need a bridge, you are already fighting against statistical gravity.

Bridges rarely save startups. They mostly just delay the outcome.

To understand why, we have to look at two specific datasets from Carta.

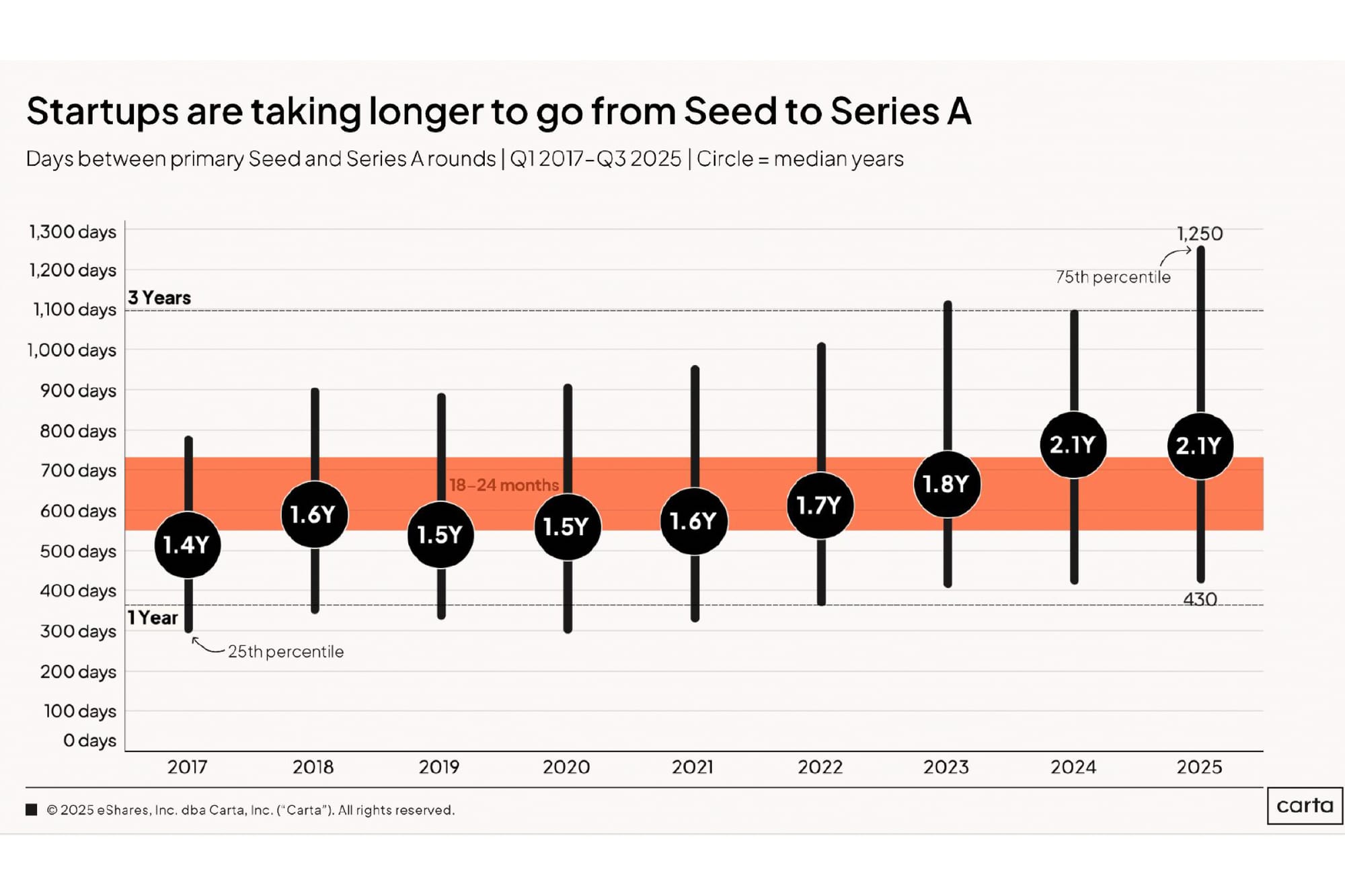

First, the timeline. It now takes a median of 2.1 years to go from Seed to Series A. That is a long time to survive on a standard 18-month seed round.

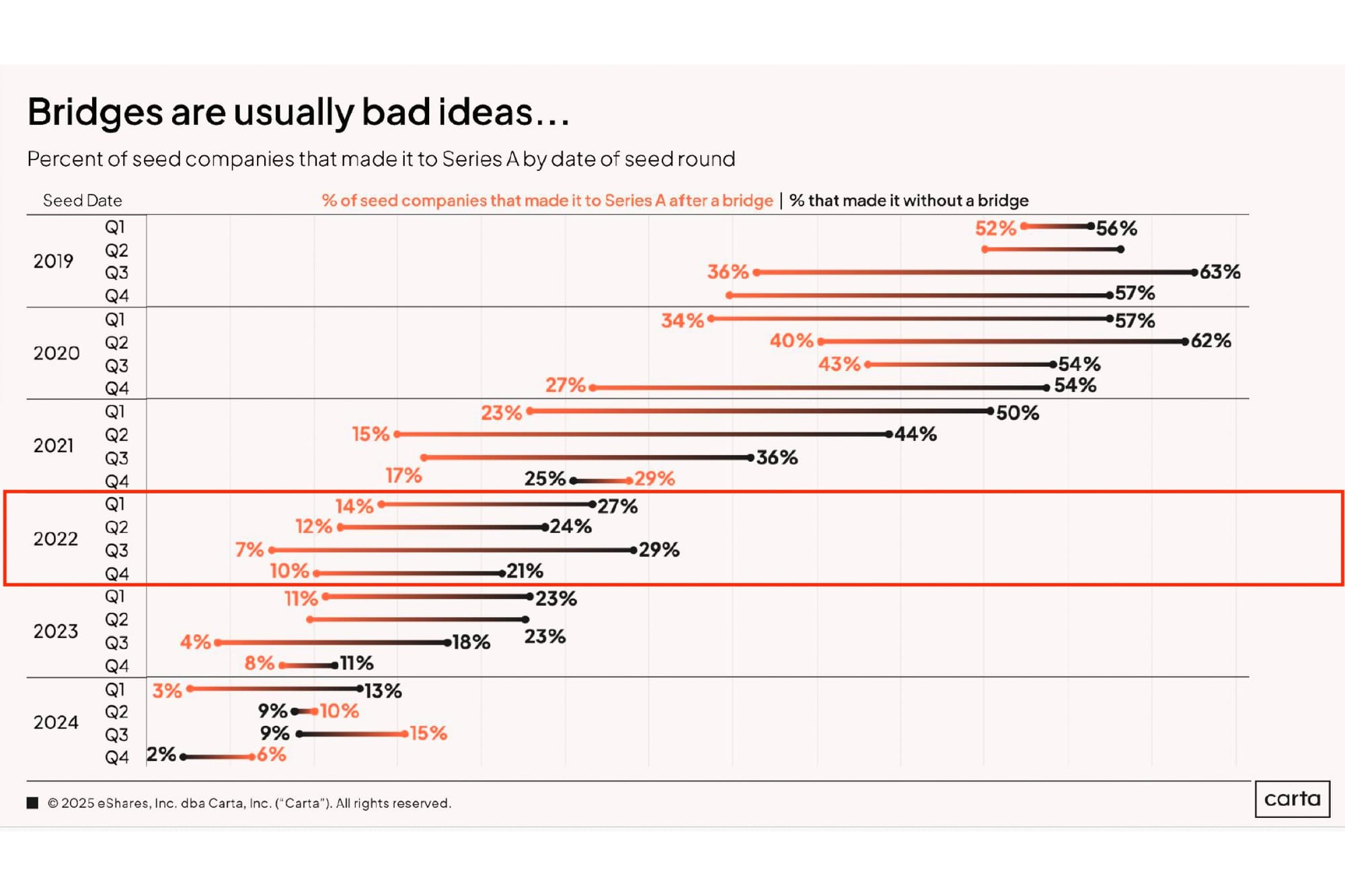

So, we have to look back at the 2022 cohort—companies that have had enough time to face this reality—to see what happened.

The difference in outcomes is purely bad math.

👉 Companies that didn't need a bridge: Graduation rates ranged from 21% - 29%.

👉 Companies that took a bridge: Graduation rates collapsed to between 7% and 14%, reducing the likelihood of raising the Series A by at least 50%.

If you need a bridge, you are statistically twice as likely to fail as a peer who doesn't.

Why is the drop-off so severe?

It isn't just about cash. It's about signal.

When you ask for a bridge, you aren't just asking for "more runway." You are signaling to the market that you missed your milestones in the standard timeframe. You become "distressed inventory."

A bridge round creates cap table complexity. It often comes with valuation overhangs. And historically, it signals that the core engine of the business isn't working fast enough.

So, how do you handle a cash crunch without ruining your odds?

🔥 Proactively manage your cash burn.

If the search for product-market fit is taking longer than expected, deal with it before you're in a crisis. Lower cash burn. Extend your runway. Give your team the time they need.

🌁 Bridge to a certainty, not a maybe.

A bridge to "find product-market fit" is a gamble. A bridge to "onboard a signed $500k contract" is an investment. A bridge through an M&A process is at least recognition that you're off the funding path and a safe landing is the best option. If the milestone isn't well-defined and achievable, the bridge likely won't fix the problem.

🪤 Avoid the valuation trap.

If valuation is the blocker to a larger priced round that provides the runway you need to achieve key milestones, lower it. A clean down round is painful, but a messy bridge structure is often a dead end.

A bridge doesn't reset the clock. It usually just ticks faster.