Investor expectations for startup exits have cooled significantly. This shift signals a more challenging environment for founders planning for a near-term liquidity event.

Only 34% of VCs now anticipate moderate improvements in exit activity over the next 6-12 months. This is a steep drop from the 70% who held the same view in H2 2024. As the chart illustrates, a growing number of investors are now preparing for stagnation (25%) or even a decline (28%) in exit activity.

💡 What’s Driving the Cautious Outlook?

This change in sentiment isn’t happening in a vacuum. You won't be surprised by the two specific macroeconomic factors that VCs see as current blocks to liquidity.

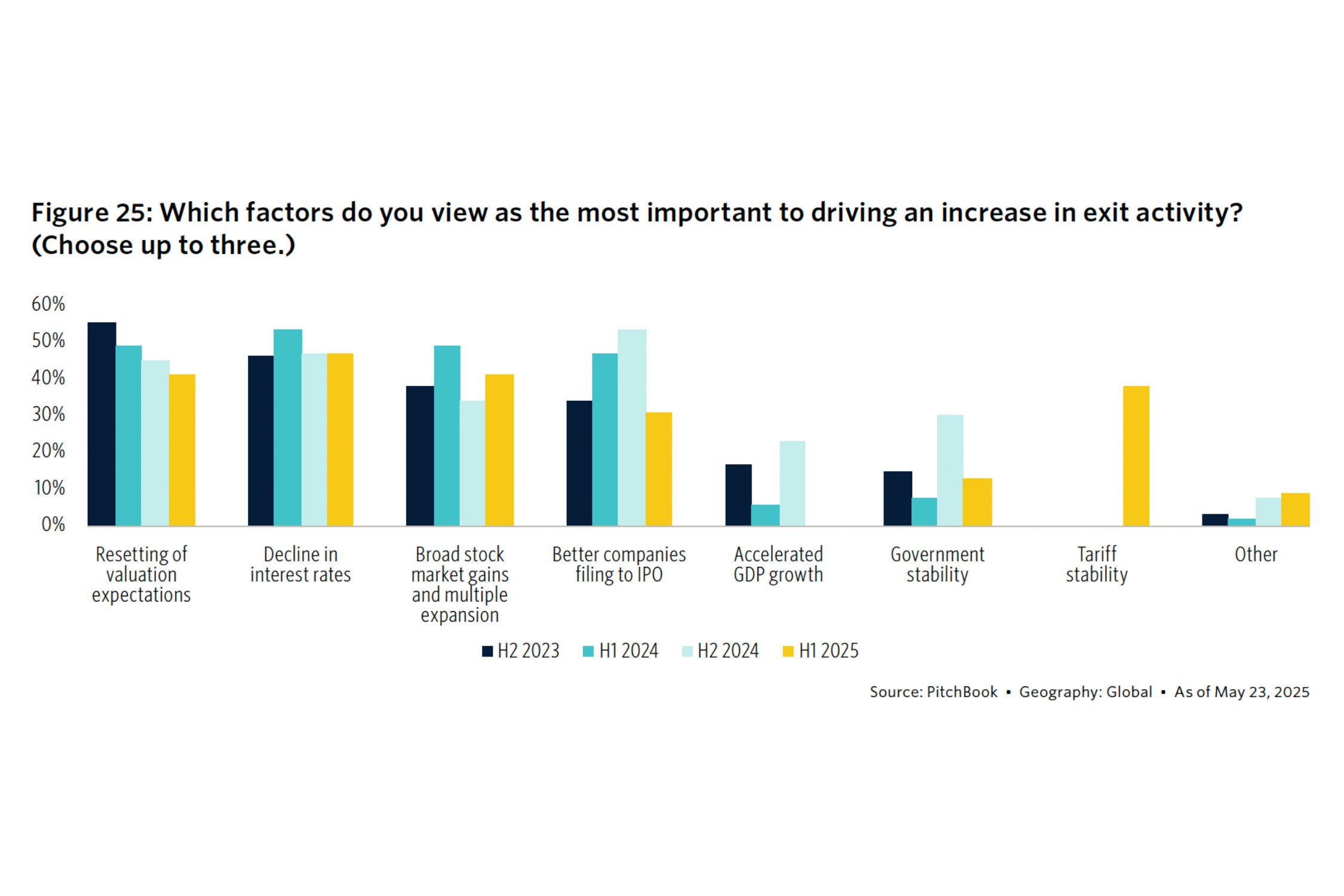

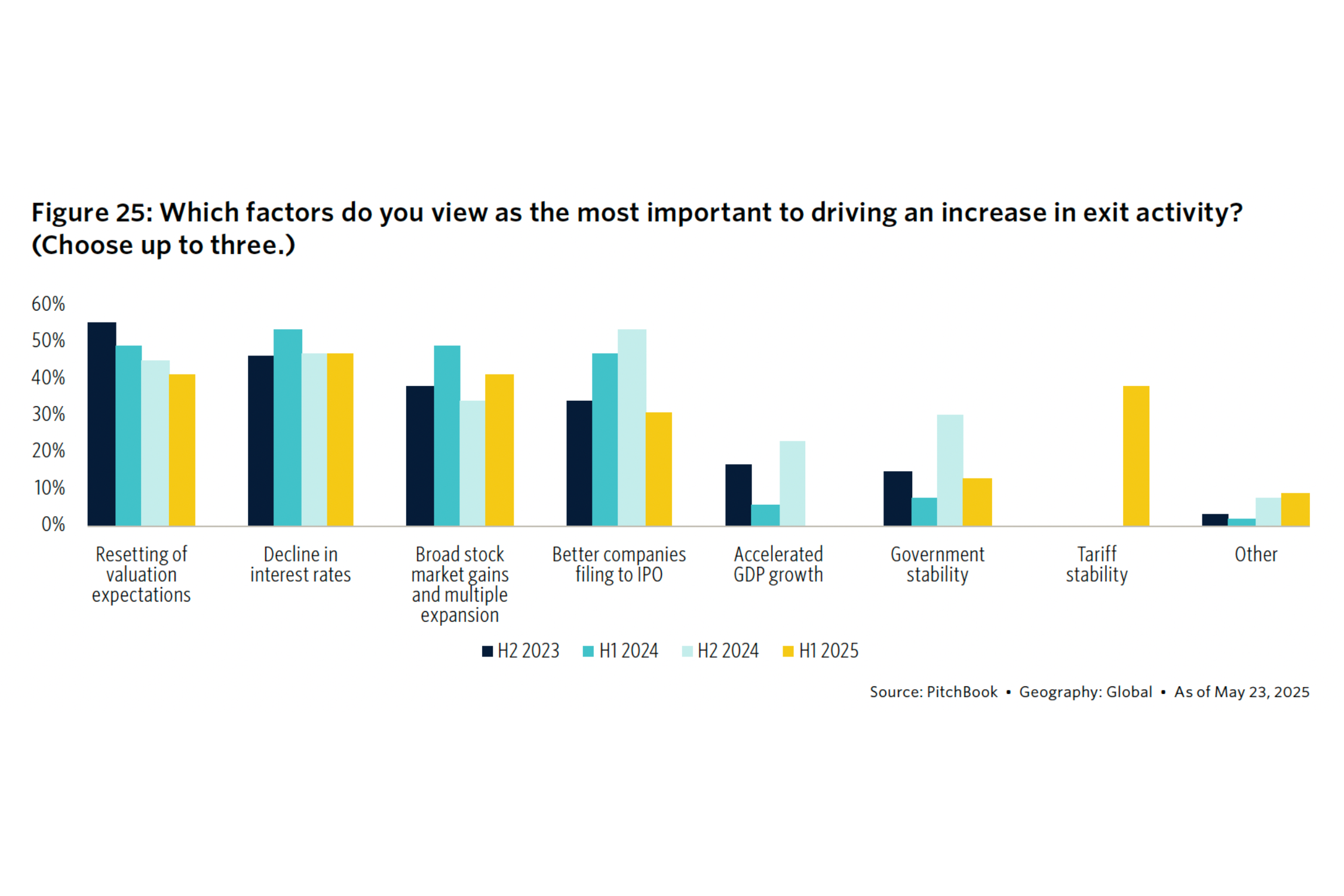

➡️ High Interest Rates: 47% of investors identified a declining interest rate environment as the most important factor driving an increase in exits. VCs view the current cost of capital as a direct impediment to M&A and IPO activity, suggesting that until conditions ease, liquidity will remain tight.

➡️ Tariff Uncertainty: Tariff stability will be a critical driver for increasing exit activity, cited by 38% of VCs. Geopolitical and trade uncertainty is a primary concern for investors, impacting their confidence in valuing and selling companies.

🚨 What Should Founders Do Now?

This shift requires a pragmatic response.

➡️ Revisit Your Timeline: The runway for achieving an exit is likely extending. Founders should stress-test their operational and financial plans against a longer horizon.

➡️ Focus on Fundamentals: With exit opportunities narrowing, a clear path to profitability and strong unit economics are more critical than ever.

➡️ Align with Your Board: This is the time to ensure your board and investors are aligned with a potentially longer, more capital-efficient journey. Proactive communication can prevent misalignment down the road.

The exit landscape remains tight. For founders, this environment demands a disciplined focus on building a resilient business with the operational strength to control its destiny.