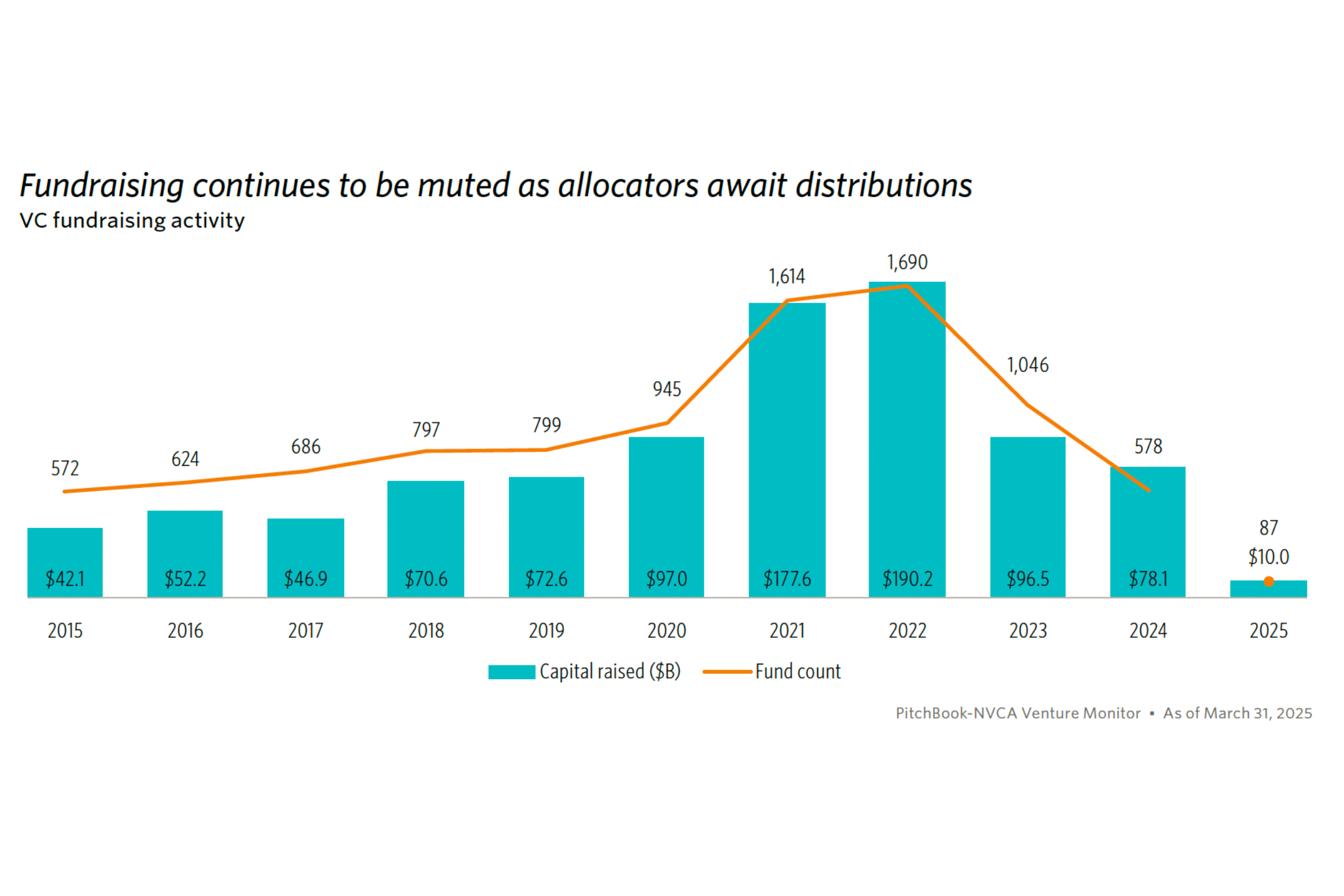

In Q1 2025, VCs raised only $10.0 billion across a mere 87 funds. If this pace continues, we're looking at the lowest annual fundraising total in a decade.

Why the Slowdown?

The core issue? Liquidity. Or rather, the lack of it. Limited Partners (LPs), the investors who fuel VC funds, haven't seen significant distributions (cash back from successful exits) over the past three years. Think of it like this:

- LPs invest in VC funds.

- VCs invest in startups.

- Startups (ideally) exit, returning capital to VCs, who then return it to LPs.

That last step has been sluggish. Fewer big exits mean LPs have less capital to reinvest. This directly impacts VCs' ability to raise new funds. Consequently, fund managers are slowing down their investment pace from recent funds to conserve capital.

What Does This Mean for Founders?

The fundraising climate just got tougher. With VCs holding onto their cash more tightly, you need to be even more strategic.

- Is your runway truly sufficient? The median time between funding rounds continues to increase. According to Carta, the average time between Series A and B is now 2.7 years. Re-evaluate your burn rate and cash reserves. Can you extend your runway without immediate external capital?

- Is your value proposition undeniable? In a capital-constrained environment, only the most compelling, de-risked opportunities will get funded. Your path to product-market fit and profitability needs to be crystal clear.

- Are you exploring all funding avenues? Beyond traditional VC, are there strategic partners, grants, or non-dilutive options to consider?

- Do you have a path to profitability? The definition of Default Investable continues to shift. Find a path to Default Alive, and be prepared to take it.

Navigating a Chilly Climate

A slowdown in VC fundraising isn't a death knell for innovation. But it does demand a shift in mindset. The "growth at all costs" era, fueled by readily available capital, is on pause. Now, it's about sustainable growth, capital efficiency, and demonstrating a clear path to profitability. Prepare for a marathon, not a sprint.