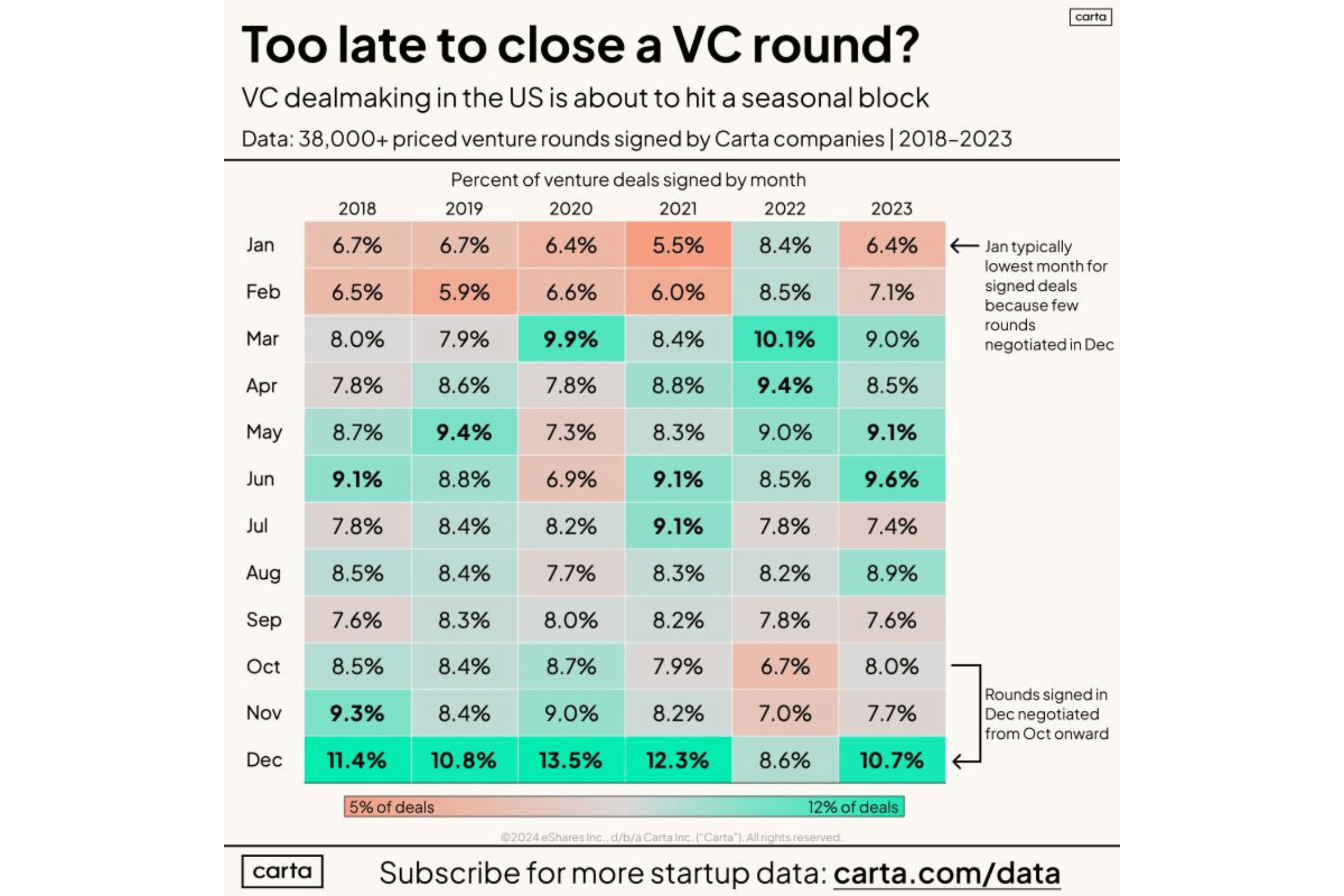

This table on the timing of closing VC rounds reinforces an important point about fundraising.

The timing of your process matters.

November and December are the worst months to launch a fundraise. Only 6.4% of venture rounds closed in January 2023. You're battling against a calendar shortened by holidays and competing for attention from investors closing deals they've worked on since Labor Day.

Despite whatever pressure you might feel to try to launch your process right now, don't do it.

You can do three things in the next 6 weeks to prepare you for launching your round in the new year.

Get Ready To Move Fast

Momentum in a process is critical to its success. Start the year 100% ready to drive your fundraise to a successful completion.

- Finalize your pitch deck and financial model

- Create your target investor list. If you need introductions to specific investors, start that process now.

- Get your data room ready. Be prepared to move from pitch to NDA to data room as quickly as investors are ready.

Extend Your Runway

If you were planning to launch your fundraise now, you were likely hoping you would be closing that round by the middle of Q1. That's not going to happen.

Give yourself as much time as possible to close this round.

Reset your cash runway horizon until at least the end of Q2. Can you extend it to the end of Q3? Make hard decisions now that can reduce cash burn and give you more time to successfully raise in 2025.

Watch Out for Macro Shifts

We're in a period of economic uncertainty with a change in federal economic policy looming. Investor sentiment can move fast.

Pay attention to the impact these changes can have on every part of your business model. Higher COGS? Shifting consumer behaviors that could impact your go-to-market strategy? Changes in regulations that could open or close pathways entirely?

Stay nimble. Be prepared to adjust your pitch and financial model to ensure your pitch connects with investors in the new year.