I often write about how much harder it's become to raise a Series A over the past few years. But what does it mean when VCs raise the bar? What new pressure does that put on a founder?

Let's look at one of investors' favorite sectors, SaaS, to see what this squeeze looks like on the ground.

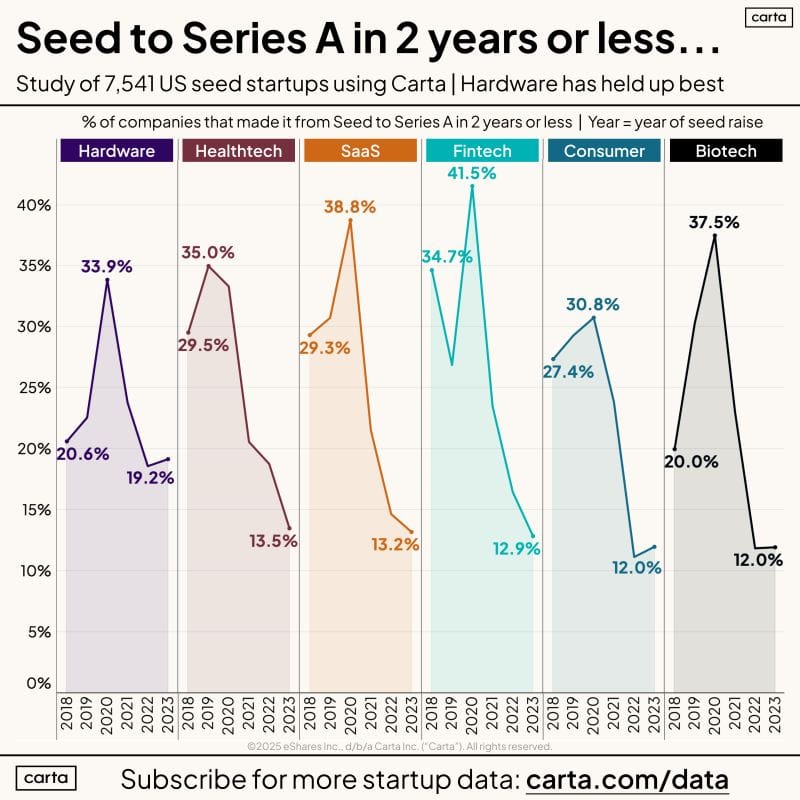

According to a study by Carta, the percentage of SaaS companies that made it from Seed to Series A in two years or less has fallen dramatically. After peaking at 38.8% for the 2020 seed cohort, it dropped to just 13.2% for the 2023 cohort.

Raising your Series A is no longer a simple race for growth. Founders today face a difficult new squeeze: the pressure to hit a dramatically higher revenue target while spending far less cash to get there.

📈 The Revenue Bar Tripled

The first part of the squeeze is the new revenue target. The old benchmark of reaching $1 million in ARR to be "Series A ready" is gone.

➡️ Today's Target: Investors now expect to see $2-3 million+ in Annual Recurring Revenue ("ARR") to have a serious conversation.

Great. That's easy. We'll just invest a large portion of our seed round in customer acquisition to grow revenue and then hope to close our Series A before we run out of cash. A tried-and-true playbook.

Not so fast.

💸 Your Burn Is Now Under a Microscope

The second part of the squeeze is the intense pressure on your cash. The "growth-at-all-costs" era, where high burn was often tolerated in the name of speed, is definitively over.

➡️ Today's Target: Your burn multiple is a critical signal of efficiency. VCs are looking for a burn multiple under 2x, meaning you spend less than $2 to acquire $1 of new ARR. A few years ago, investors barely emphasized this metric. Now, a high burn rate is a major red flag.

🚫 No Cheating on Other Metrics

Here's what makes the current environment so challenging. While the targets for ARR and burn have changed dramatically, the expectations for all other core SaaS metrics have not loosened. You must still perform at an elite level across the board.

There is no slack here. You are still required to hold the line and show:

➡️ Strong YoY Growth: A 3x+ growth rate is now the standard expectation.

➡️ Elite Retention: A best-in-class Net Revenue Retention (NRR) of 120% or more is the goal.

➡️ Healthy Unit Economics: A LTV:CAC ratio of at least 3:1 remains the baseline minimum.

➡️ Fast Payback: A CAC payback period of around 12 months is ideal.

The Real Challenge

The difficulty isn't just hitting one new number. The true challenge is generating 2-3 times more revenue than was required before while demonstrating significantly more capital efficiency. All while your other core metrics remain impeccable.

This is the new Series A fundraising environment. It demands a level of operational discipline that wasn't required in the last cycle. Can your operating plan deliver explosive growth and operational efficiency at the same time?