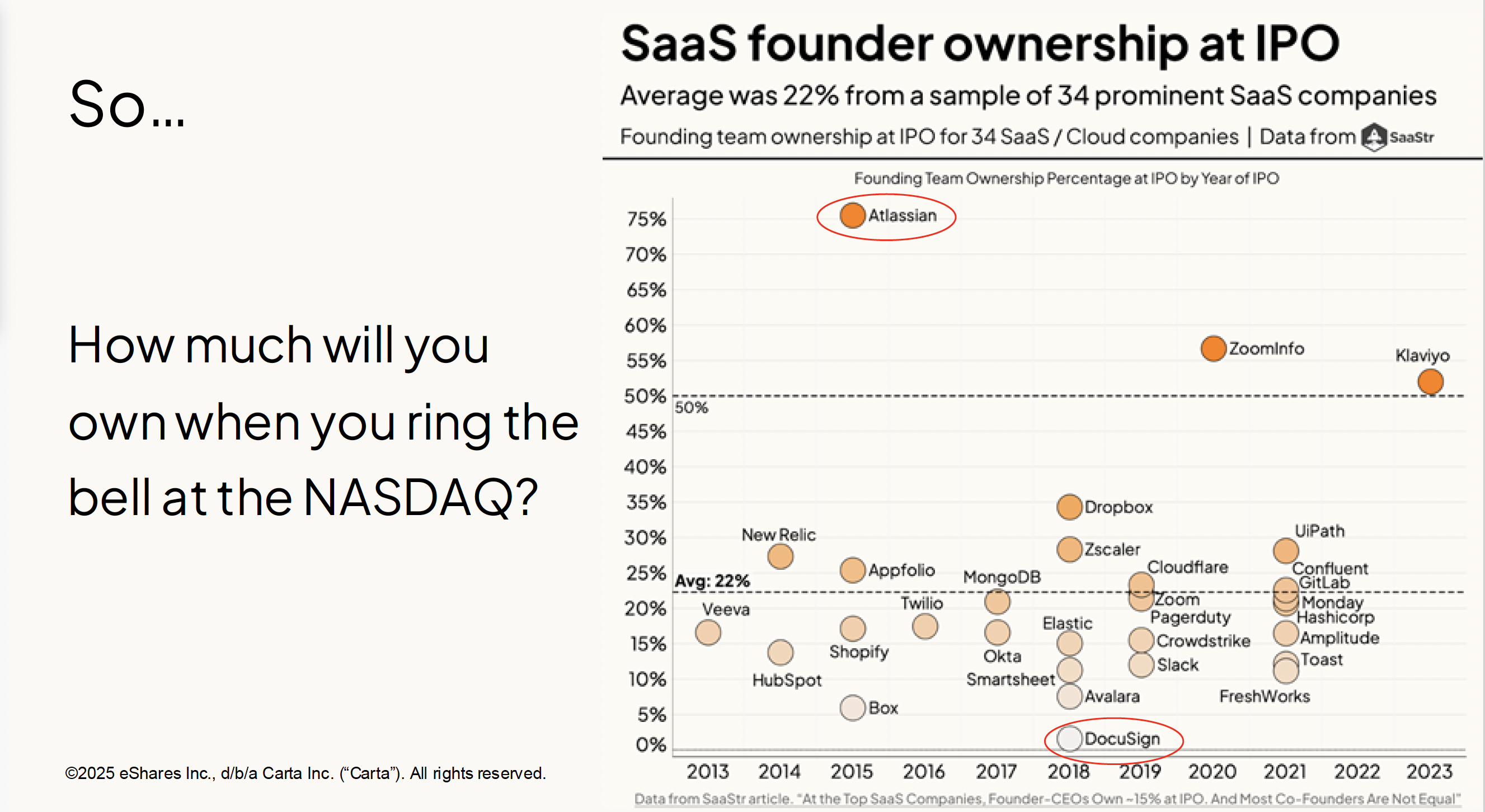

You’re building a venture-backed startup, dreaming of the day you ring the bell at NASDAQ. But when you get there, how much of the company will you and your co-founders actually own?

The data shows a wide range of outcomes. A recent analysis of prominent SaaS companies found the average founder ownership at IPO was 22%.

As the chart shows, some founders—like those at Atlassian and Klaviyo—held onto impressive stakes. Others, like Box and DocuSign, owned far less.

But that percentage doesn't tell the whole story.

💰 What Is Your Stake Actually Worth?

At every funding round, you're balancing three things:

- The current value of your ownership stake—and the odds of turning that into cash via a sale or IPO

- The ability to pivot to profitability and run the business for cash flow

- The impact of raising fresh capital—across dilution, valuation, and preferences

An ownership percentage is just a number. What really matters is how much your stake actually pays out—after preferences and dilution.

Every time you raise capital, you issue preferred stock. That comes with rights that protect your investors—especially liquidation preferences, which ensure they get their money back (often with a multiple) before you and your team see a dime.

These preferences stack up with every round. Even in a strong market, they can materially shrink what’s left for common shareholders. And in today’s environment—where 1 in 5 funding rounds are down rounds—founders are often trading more dilution, tougher terms, and less upside for the capital they need to keep going.

🤔 How Should You Think About Your Next Round?

Simply raising more money isn't always the best answer. The goal isn't just to have a high ownership percentage on paper. The goal is to maximize the actual financial outcome for you and your employees.

Before your next round, ask:

➡️ Will this capital meaningfully increase valuation—or just add dilution?

➡️ Are we trading long-term downside for short-term optics?

➡️ What exit value actually delivers upside for the team?

Building a company is a long journey of critical decisions. Understanding the trade-offs between dilution, valuation, and control at each step is essential to ensure you’re the one who benefits most from the value you create.

It’s easy to focus on the dream of ringing the bell. But the real win is making sure you and your team share in the value you’ve created when that day comes.