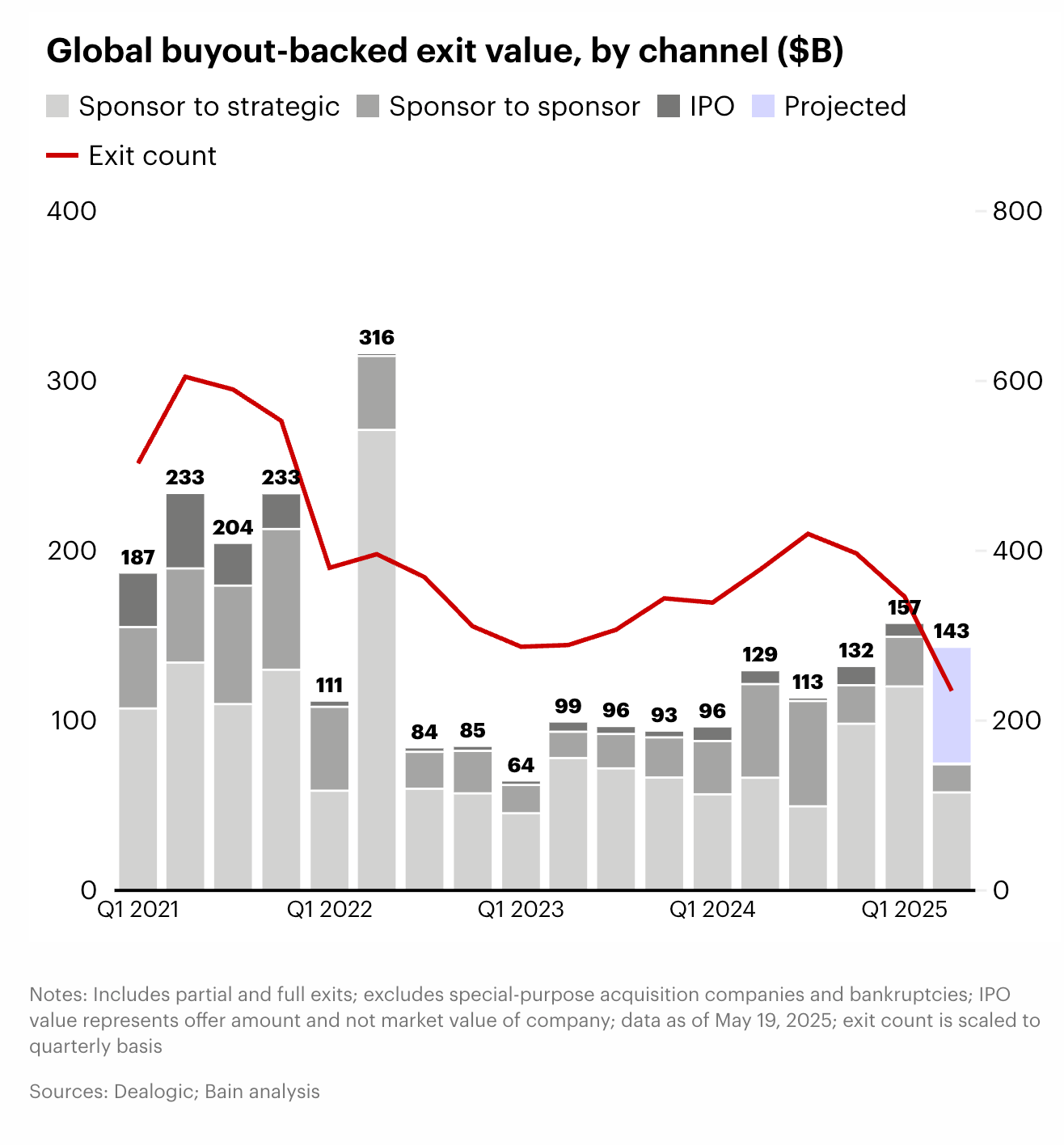

This was supposed to be a boom year for M&A and IPOs. But if there is one thing markets don't like, it's uncertainty. Tariff turmoil and regulatory uncertainty slow markets until the impacts are better understood.

Q1 started off promising, but Bain just issued a report on Q2 exits and liquidity, and the news isn't good.

Why does this matter to startup founders?

Because exits and IPOs fuel distributions to venture fund LPs.

When LPs receive distributions, they have dry powder to reinvest into venture and private equity funds.

When distributions are as woeful as they have been over the past few years, LPs stop investing in these asset classes.

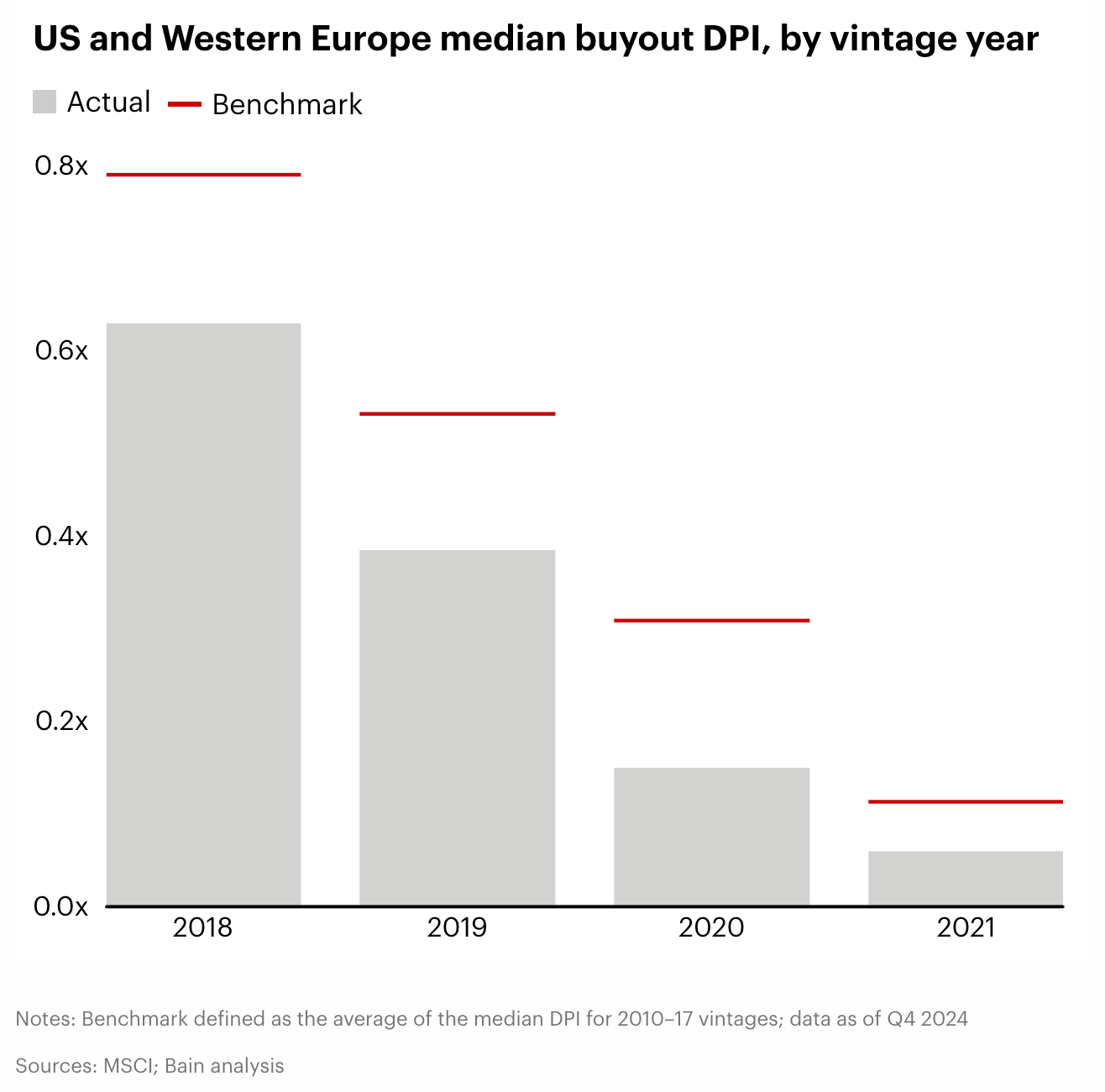

Looking at distributions through Q4 2024 for funds from 2018 - 2021, we can see that DPI (Distributions to paid-in capital) continues to lag historical benchmarks.

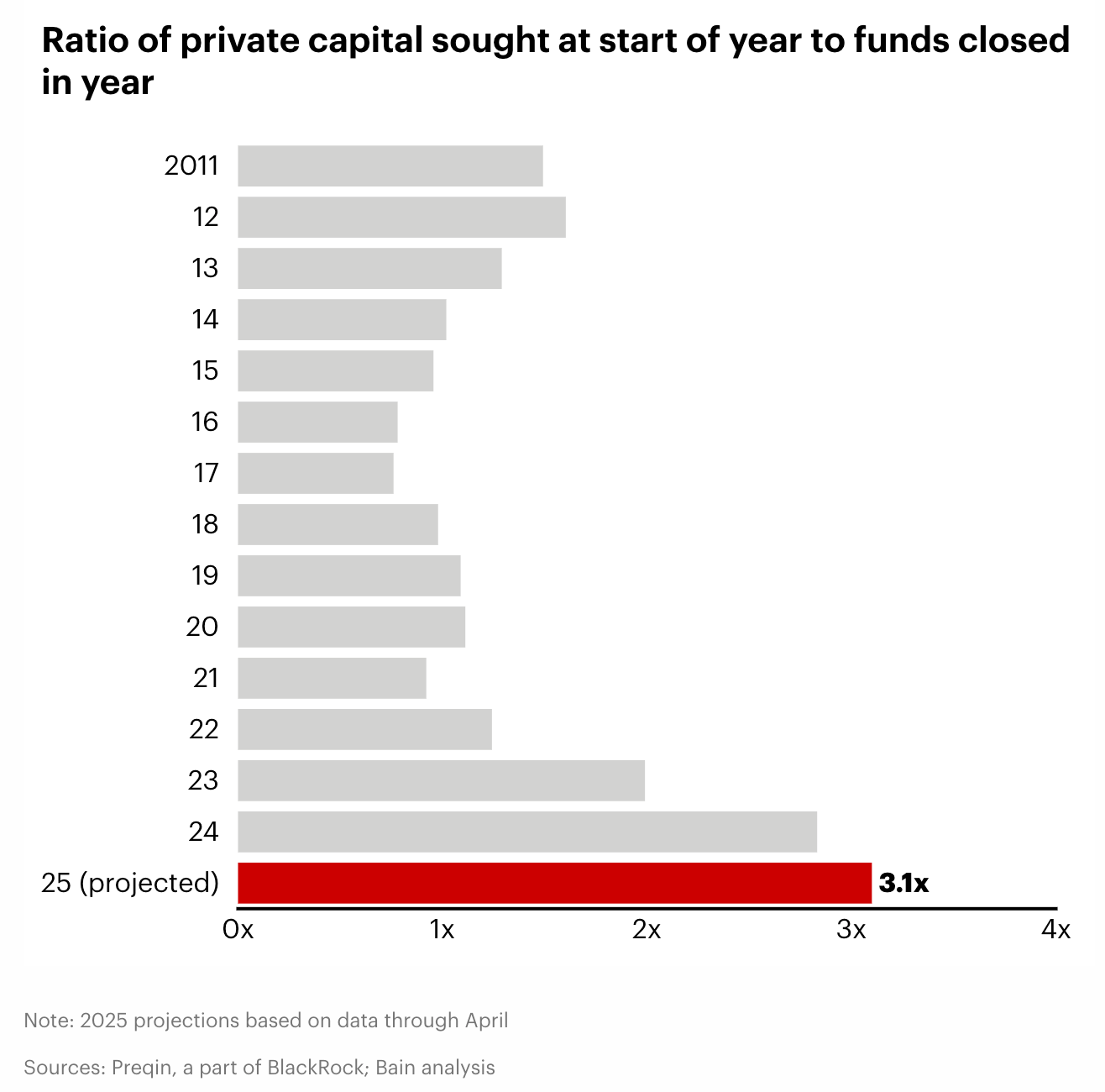

And when that happens, funds can't raise fresh capital. According to Bain, More than 18,000 private capital funds are on the road, collectively seeking $3.3 trillion. That means there’s about $3 of demand for every $1 of supply.

That means smaller than expected funds. More zombie funds with no fresh capital to invest.

Most importantly, it means fewer startups can be funded. We'll see lower valuations and tougher terms. More activity will continue to be concentrated in the largest funds that can raise limited dollars from LPs.

We've been watching this trend for a while. The expectation was that 2025 was the year this trend turned around. While we can hope for improvements in the second half of the year, hope is not a strategy.

A few suggestions as you meet with funds this year:

- Focus your fundraising efforts on funds that have announced a final close within the last 12-18 months. These funds have both the capital and the mandate to make new investments, making them less constrained by the liquidity issues plaguing older funds.

- If you're an early-stage startup, you're raising this round to achieve milestones that will ensure you can raise your next round at a higher valuation. If you're a later-stage startup, you should be laying the path to an exit. Show that you have a plan to build value and deliver a successful outcome for you and your investors.

- Tell the story of capital efficiency. It's not just about chasing top-line growth while burning through rounds of venture capital. Demonstrate your understanding of delivering scalable growth through strong gross margins. Talk about sales and marketing efficiency through your understanding of customer lifetime value and acquisition costs. Demonstrate that you aren't just a short-term bet but a company with the potential for a significant, long-term return that can help improve a fund's performance.