You have a blind spot in your exit strategy.

Most founders obsess over the "Trillion Dollar Club." You build relationships with corp dev teams at Google, Salesforce, or Microsoft, hoping for a strategic premium.

Those deals still happen. But while you are gazing at the giants, you are missing the most active acquirers in the market right now: The competitors sitting right next to you.

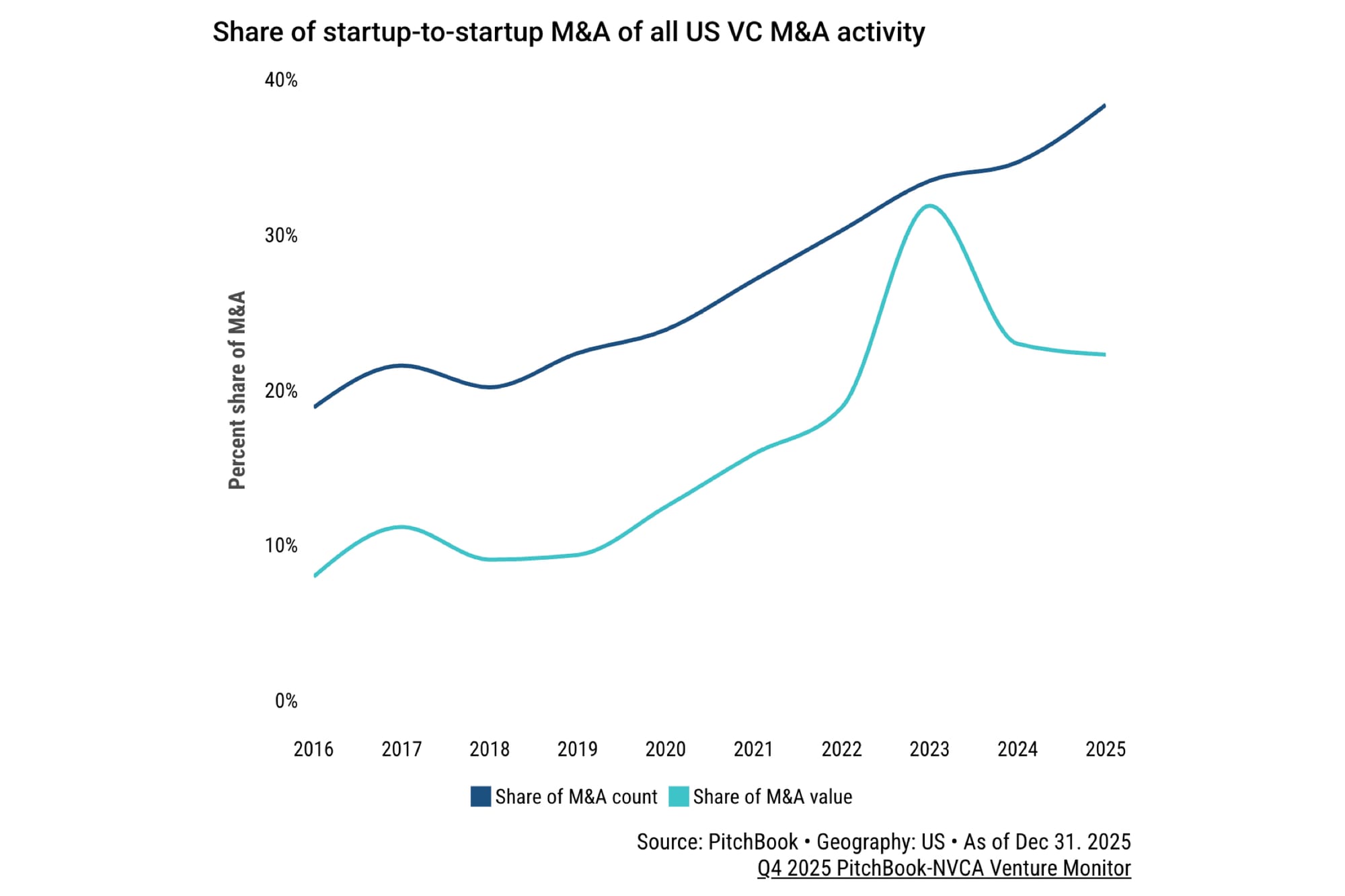

New data from Pitchbook confirms an important shift in M&A activity. Take a look at the chart below.

38.4% of all VC-backed acquisitions are now done by other VC-backed startups.

The IPO market has fundamentally changed. Sapphire Ventures partner Anders Ranum notes that the revenue bar to go public has jumped from $150 million to over $500 million.

This new threshold has created a specific class of buyer: The "Private Rocket Ship."

These are late-stage companies (Series D/E) that have massive cash piles but haven't hit the $500M revenue mark yet. They are on a sprint to IPO, and they cannot get there on organic growth alone. They need to buy revenue, and they need to buy it fast.

This is where you need to check your ego.

In crowded markets like AI, "For every one company, there's 25 competitors." The market will not support 25 public companies.

If you are ranked 5, 6, 7, or 8 in your category, you are not "losing." You are a prime target.

The market leaders are looking to consolidate the field. They need your talent, your customer list, and your ARR to secure their own dominance.

As the report notes: "Selling to a private rocket ship can still be very meaningful."

You need to broaden your definition of an "Exit."

🏃♀️➡️ Identify the Sprinters: Look at your sector. Who just raised $200M+? Who is openly talking about an IPO in 2027? That is your buyer.

👉 Swallow the Pride: Selling to a competitor feels like conceding. It isn't. It is recognizing that being a key part of the market winner is better than being a standalone zombie.

💰 Vet the Equity: These deals often involve stock. If you sell to a pre-IPO company, their stock is your lottery ticket. Diligence their path to $500M as hard as they diligence your code.

The M&A channel is wide open, but don't just look up at the giants. Be honest about your own situation and pay attention to the emerging winners in your own cohort.