Funding

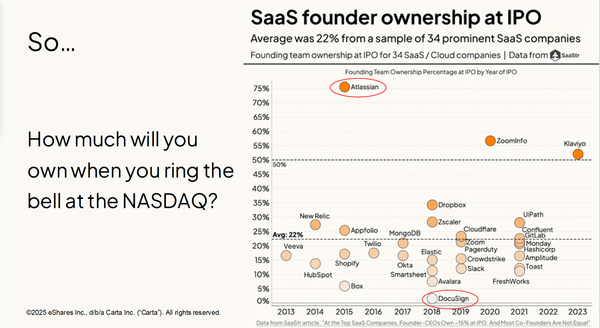

What's Your Ownership Stake Really Worth?

Founders obsess over ownership percentage. Wrong metric. Your 20% stake could be worthless if the preference stack is too high.

Funding

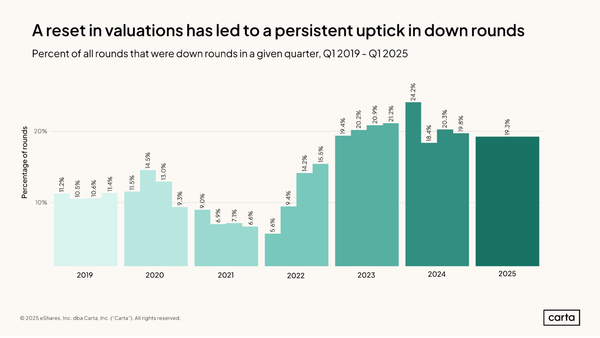

1 in 5 venture rounds since 2023 has been a down round. A down round isn't failure. It's a strategic reset, reflecting a market that has fundamentally changed and now demands stronger fundamentals.

Funding

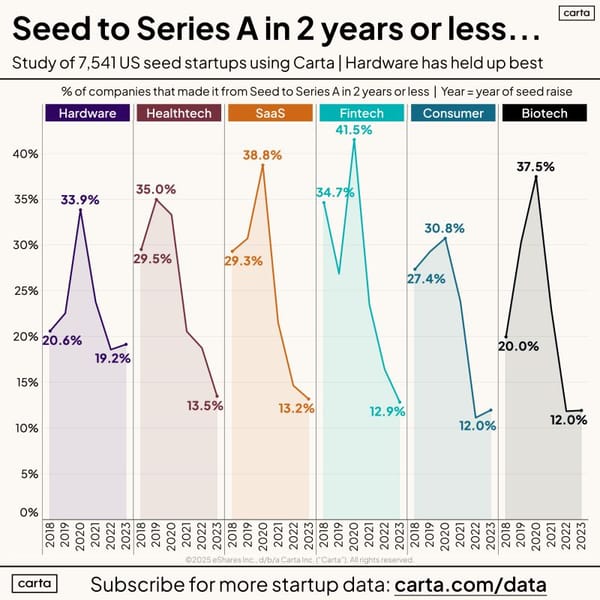

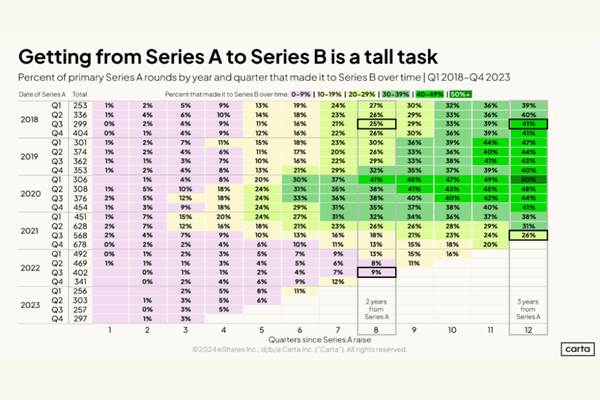

In 2020, 39% of SaaS startups raised a Series A within 2 years of their seed round. That number has now fallen to just 13%. This is what the Series A squeeze looks like.

Leadership

Most founders treat board meetings like status updates. That’s a mistake. It’s your chance to lead with a clear narrative—build conviction before you ask for help. Investor support must be constantly earned.

Why do some startups, despite raising over $100 million and achieving unicorn status, end up with little to show for it? The startup press and many founders are obsessed with valuation. But that can be a trap. During a liquidation event, the most important factor is how the cash is

Fear. Uncertainty. Doubt. As a founder, it’s easy to believe these feelings are weaknesses. They lay the foundation of imposter syndrome. But when properly channeled, fear, uncertainty, and doubt are founder superpowers. They help you find the path to profitable, scalable growth. They allow you to stay in control

You’re trying to boil the ocean. You had a simple idea for a startup. One problem to solve. A solution to a common pain point that would attract customers and keep them coming back. You were targeting a small market at first. But that’s ok. You had a

The Scooter company Bird filed for bankruptcy yesterday. Another high-flying unicorn falls to earth. This is an important reminder that you can’t believe the hype in the startup press.

Welcome to part one of our series on down rounds and recaps: * Part 1: A Guide to Down Rounds and Recaps <- You are here * Part 2: Managing Your Key Stakeholders * Part 3: A Deep Dive Into Down Rounds * Part 4: Navigating the Startup Recap Let’s get into

The dog on the left is a Bavarian Mountain Scent Hound. As you can see, it’s a very serious-looking dog. Hounds are notoriously difficult to train to be off-leash. When a hound dog catches a scent, it puts its head down and starts running. They lose focus on everything

Take Charge of Your Startup's Destiny

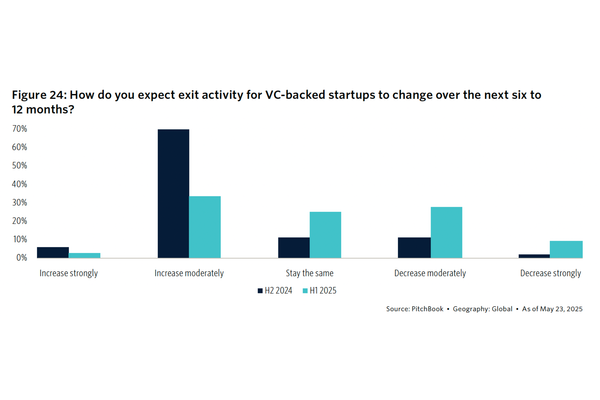

Wondering why the M&A and IPO markets are so tight? No surprise that VCs are pointing to high interest rates and tariff uncertainty as key blocks to an exit. In a tight exit market, focus on what you can control.

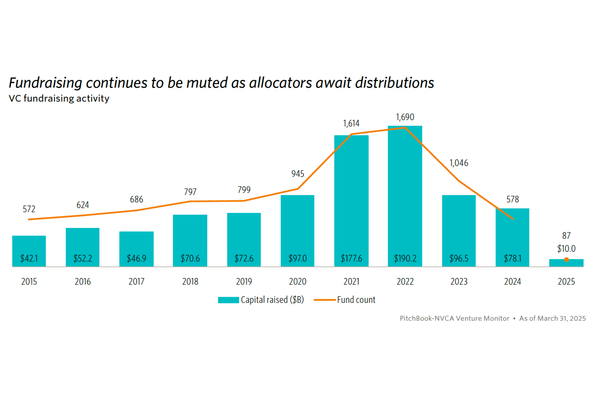

VC fundraising hit a decade low pace in Q1 2025 ($10.0B via 87 funds). For founders, this signals one of the toughest fundraising climates in years. Your metrics should be undeniable. Prepare for a marathon, not a sprint.

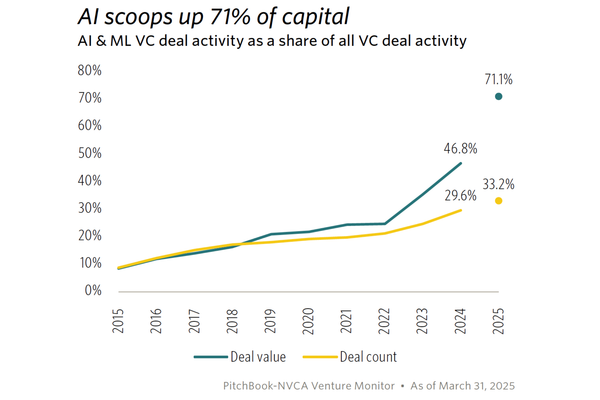

71.1% of all VC deal value last quarter went to AI. If you're building here, focus on PMF, not hype. If you're not in AI, fundraising keeps getting harder—your story needs to be sharper than ever.

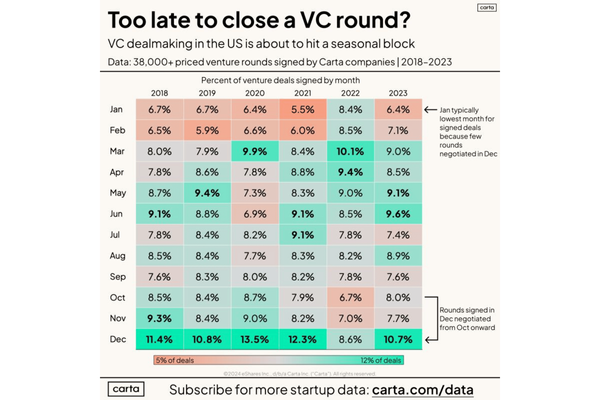

Thinking about launching your fundraise now? November & December are the worst months to start, with just 6.4% of deals closing in January. Here's what you should do.

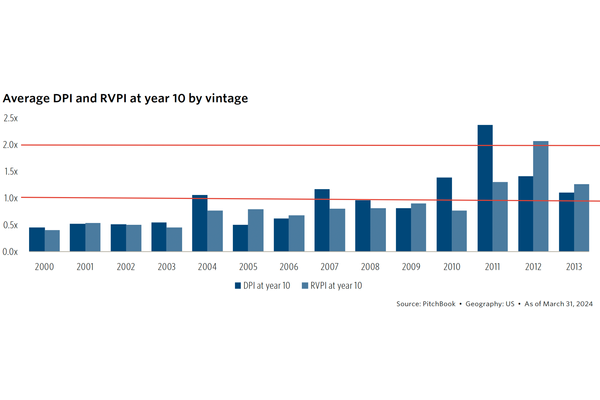

As an investment vehicle for LPs, venture capital is broken. As a founder, you need to understand this dynamic. Choose your investors wisely.

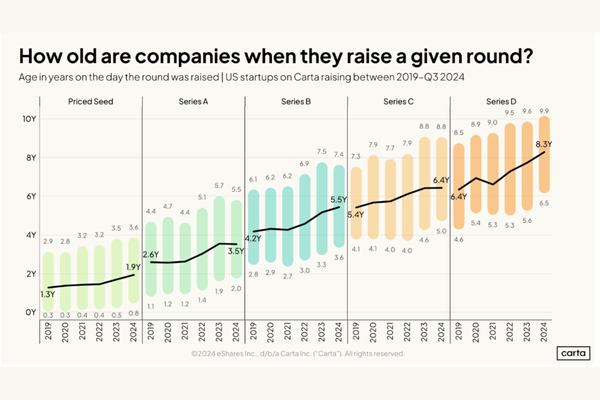

It's taking longer to raise a round of venture funding. This is a healthy change. Let me explain why.

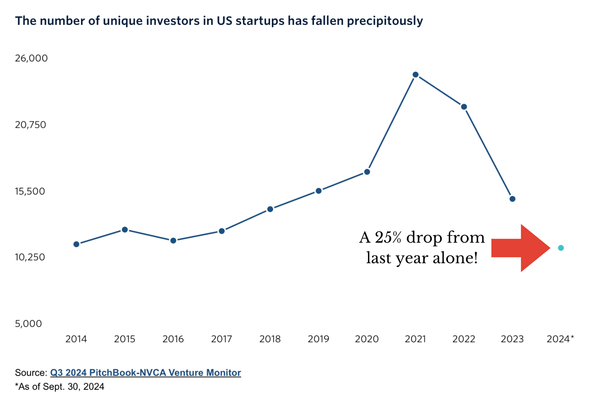

Zombie VCs are surging: 25% fewer active investors in 2024 vs 2023, and 50% down from 2021's peak. These funds can't make new investments, but their short-term focus can still cause major problems for founders in their portfolio.

This chart tells an important story for early-stage founders. Only 10% of startups that raised a Series A in 2022 have raised a Series B two years later. That drop of nearly 2/3 from 2018 represents a brutal cliff for founders.

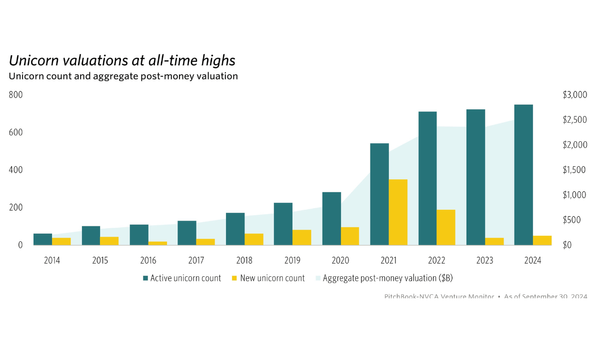

This chart is a perfect illustration of the pain still to come in venture. The explosion of ‘unicorns’ in 2021 and 2022 is the venture bubble in action. It will take years to unwind, and venture returns will continue to suffer along the way.

Most businesses aren't a good fit for venture capital. Picking the right sources of funding is one of the most important decisions you'll make. When you're pitching your mushroom farming startup as a tech company, you're on a path that's

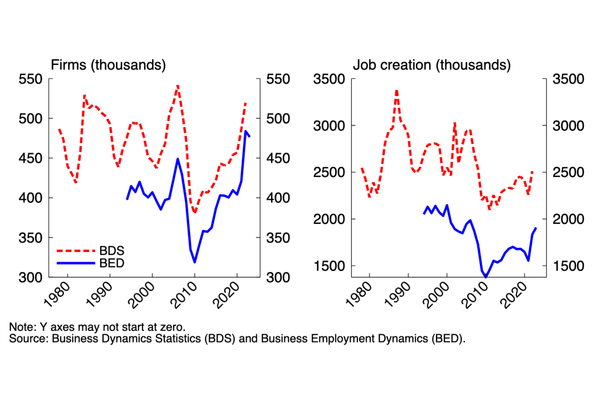

In the coming wave of AI-related disruption, we can enable entrepreneurship and unleash the job-creating forces behind it. We need to learn from the past to set the right policies for the future.

Why do some startups, despite raising over $100 million and achieving unicorn status, end up with little to show for it? The startup press and many founders are obsessed with valuation. But that can be a trap. During a liquidation event, the most important factor is how the cash is